What is National Insurance Category Letter?

Employers use National Insurance Category Letter to determine the exact amount they and their employees are required to contribute towards National Insurance. National Insurance (NI) Category Letter is necessary at the time of running payroll.

In this blog, we will talk about national insurance category letters based on State pension age, payroll outsourcing services and their role, category letters for married women, different age groups, and more.

We will also attempt to answer a few of the frequently asked questions related to employees’ national insurance and other such topics.

So, without further ado, let’s get to it.

What is National Insurance Category?

National Insurance (NI) Category determines under which category letters employee groups fall. According to the determined category, the National Insurance amount is estimated.

There are different national category letter that denote the rate at which an individual contributes and the benefits they are entitled to. For example, a national insurance category/code A covers every employee who is not included in insurance code B, C, H, J, M, V, and Z. The National insurance code can be complex; therefore, in the following section, we have given a simplified explanation of the different categories and what they mean.

What are the Different Category Letters, and What do They Mean?

Most employees are issued an individual and unique National Insurance Category Letter, which determines the amount of National Insurance that will be deducted from their wages. The category letter of every employee is available on their pay slip. The majority of the employees fall under the category letter A.

Below mentioned are the Category Letter and their respective Employee Group.

A: All employees, excluding the ones in groups B, C, J, H, M, X, and Z

B: Women who are either married or widowed are qualified to pay a lowered National Insurance amount

C: Employees who are eligible for State Pension (based on their age)

J: Employees who can postpone National Insurance as they are paying it in another job as well

H: Apprentices below the age of 25

M: Employees below the age of 21

V: Veterans starting their first job after retiring from the armed forces.

X: Employees below the age of 16 or those employees who are not required to pay National Insurance

Z: Employees below the age of 21 who can delay National Insurance because they are paying it in another job as well

National Insurance Contribution Rates

An employee’s contribution falling under National Insurance Class 1 comprises two parts. One is paid by the employee themselves as a deduction from the salary towards Employee’s National Insurance, and employers pay the second part, known as Employer’s National Insurance.

The deduction amount depends on the employee category letter, how much income they are drawing and under which category they fall. Visit here if you want to know about the statutory sick pay rates in the UK.

-

Employees Contributions

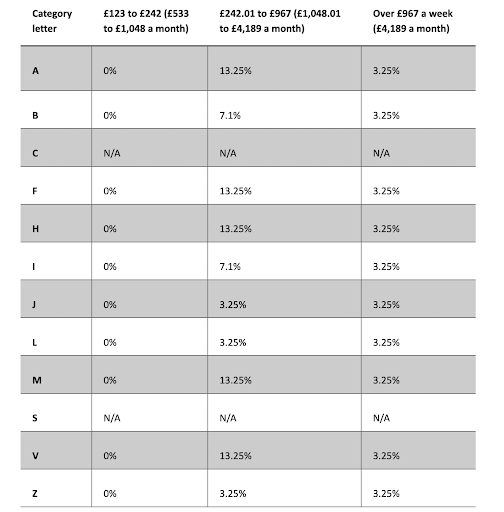

The following table shows the Employee National Insurance Rate for 2022-23. In the below NIC letter table, the first column is the Category Letter, and the second, third, and fourth are Income Brackets, as mentioned below.

Let’s understand the calculation with the help of a simple example:

Suppose you fall under Category A and your weekly income is £1,000. You will have to pay:

- Zero amount on the first £242

- 13.25% on your earnings that fall between £242.01 and £967 that is £96.0

- 3.25% on the remaining earnings that are above £967, which is £1.07

That means the total payable amount for this week’s National Insurance amounts to £97.13 for you.

-

Employers Contributions

The following table shows the Employer National Insurance Rate for 2022-23. The first column in the table below is the Category letter, and the subsequent columns show the Income Brackets.

One added clause to Employer’s Contribution is that once a year, they have to pay Class 1A and Class 1B National Insurance on any expense or a benefit they decide to incur on their employees. The rate for this varies every year. For the year 2022-23, the tax rate is 15.05%. They are also expected to pay Class 1A on other lump sum payments, such as redundancy payments. Read about automatic enrolment in pension scheme.

Frequently Asked Questions

How do I know My NI Category?

Employees can find their National Insurance Category from the category letter given on their pay slips. The majority of the employees fall under Category A. Know further information from HMRC here.

Why is National Insurance Category important for Payroll?

National Insurance Category is used to determine the National Insurance liability for employees and employers. This determination is crucial for running the payroll correctly as if you choose an incorrect category, it becomes difficult to mend the mistakes later.

The majority of the employees fall under National Insurance Category Letter A. It is the default category, meaning all the organization’s employees, not in another category, are covered. Read about the factors that affect the cost of outsourcing payroll.

What Happens if I Don’t Pay National Insurance Contributions?

Suppose you fail to pay any or all National Insurance Contributions. In that case, there will be gaps in your National Insurance record, which means you won’t be qualified for certain welfare benefits, such as maternity leave and state pension.

If you have gaps in your record, you can choose to pay a voluntary contribution to top up the missed payments.

Do You Pay National Insurance if You Don’t Pay Tax?

National Insurance Contributions are to be paid when you cross 16 years of age and are earning, or you have other sources for self-employed profits crossing a certain amount. If the National Insurance amount is duly paid, you get entitled to certain benefits such as maternity leave and state pension.

Can You Be Fined for Not Paying National Insurance?

You can be fined and penalised by HMRC for not paying your National Insurance. In case of failure, you will receive a Notice of Penalty Assessment, which you must pay within 30 days starting from the day you received the letter.

The National Insurance Contributions are mandatory for everyone above 16 years of age and earning over the minimum set limit. If you are not under the minimum threshold, you can opt-out of National Insurance.

To qualify for state benefits like state pension, you must have paid National Insurance for a minimum of 10 years and qualify for maternity allowance. You need a certain number of working years to get qualified.

Discuss with the experts at Dhpayroll if you want to know more.

Comments